Investing isn't as difficult or as expensive as most people think. Most of us just don't do it well. Here's what we do wrong and how to start doing it right -- with just $100.

Investing isn't as difficult or as expensive as most people think. Most of us just don't do it well. Here's what we do wrong and how to start doing it right -- with just $100.

By Richard Jenkins

I'll let you in on a little secret about investing: It's not nearly as hard as you think. And it requires far less cash than you probably realize.

However, the fact that most people do it badly might lead a reasonable person to believe that investing is incredibly difficult.

How badly do most of us perform? A study by Dalbar, a Boston investment research firm, found that from 1984 to 2002, when the S&P 500 Index ($INX) grew at an annual rate of 12.2%, individual investors in equity mutual funds saw average returns of 2.6% a year, before taxes.

That's downright pitiful.

So with the bar set appropriately low, I'm going to show you a method for starting and managing a portfolio that requires very little money (just $100), even less effort, minimizes taxes and transaction fees, and is likely to outperform the vast majority of mutual funds over the long haul.

So many investors, so little profit

First, let's look at the reasons for the awful performance of most investors. There are as many reasons as there are overpaid CEOs, of course, but here are the primary culprits:

• Market timing. A lot of investors believe that there's a right time and a wrong time to invest in stocks, and that it's possible for most of us to predict which is which. That's dead wrong, according to a classic study by William F. Sharpe, Nobel Prize-winning economist and a founder of Modern Portfolio Theory, a widely followed statistical method for minimizing risk while maximizing investment returns. The study revealed that a person who attempts to time the market needs to be right roughly three times out of four to match the performance of a buy-and-hold investor. Given that the market tends to make major moves in response mainly to unexpected events, that 75% accuracy rate can be a tough mark to hit, as the dismal record of individual investors demonstrates.

• Buying high and selling low. This is one consequence of failing to time the market correctly, and it most often results fro

• Failure to diversify. Most often the product of an accumulating pile of company stock, usually in a 401(k), it also can reflect a poor understanding of different types of asset classes and how they move in relation to one another. Diversification and strategic asset allocation are the keys to minimizing volatility while maximizing returns -- and thereby getting a good night's sleep.

So what is this strange voodoo called asset allocation? It's a method for spreading your investment dollars across different types of investments. (By contrast, diversification usually means buying a variety of securities within each investment type.) Asset allocation is the core of Modern Portfolio Theory.

And before you fall asleep on me, let me show you just how well it works. Roger C. Gibson, the author of "Asset Allocation: Balancing Financial Risk," has just updated his 30-year study of the performance of a variety of diversified portfolios. The simplest of these, for illustration purposes, consists of 25% each of four major asset types:

• U.S. stocks, represented by the S&P 500 Index.

• Foreign stocks, represented by the EAFE Index (Europe, Australia and Far East).

• Real estate, represented by the National Association of Real Estate Investment Trusts Equity Index.

• Commodities, represented by the Goldman Sachs Commodity Index.

The chart shows what $1 invested in each one of these asset classes in 1972 would have been worth at the end of 1998 and 2002, versus the combined portfolio, which is rebalanced each year to restore the equal weighting of each type of asset.

Taming the bear

When the third edition of Gibson's book was published in 1999, near the end of a 16-year bull market, the value of the equal-weight portfolio was running neck and neck with the sizzling hot S&P 500. But you can see a big divergence of performance since then. It's during bear markets that asset allocation really makes a difference.

The key to success is finding asset classes that tend to respond differently to the economy's ups and downs. For example, in 1973 and 1974, when both domestic and foreign stocks and real estate fared badly, commodities soared. Over the following two years, commodities tanked while stocks and real estate gained substantially.

But what do you do if you're just getting started and have only a few hundred, a thousand or maybe a few thousand dollars to launch your assault on the capital markets? Fear not! The range of low-cost mutual funds and other instruments available to you has exploded in recent years, and I'm going to give you a step-by-step guide to building a smart, secure and properly diversified portfolio. This strategy works for building a portfolio with any amount of money, but it's great for those starting small.

The shoestring approach

For the small-dollar investor, one of the best ways to get started is to buy exchange-traded funds, or ETFs. These are instruments that trade like stocks and mimic the behavior of a variety of different types of assets (stocks, bonds, real estate or commodities) or indexes (S&P 500, Dow Jones Industrials ($INDU), Russell 2000 ($RUT.X).

So let's say you get a $100 tax refund and want to start investing. I know of only one broker that has no minimum account size and charges as little as $4 in commissions for each security purchased, and that's Sharebuilder.com. Those costs are low enough to make investing in such small amounts practical, if not cheap.

(If you have $10,000 or more to invest, you're better off buying mutual funds that track the same indexes as the ETFs listed below. There are no commissions for buying and selling fund shares at many discount brokerages. Funds aren't an option for investors with small sums to invest because of the funds' minimum purchase requirements, typically $2,500 or more, although these are often much lower for IRA accounts.)

After opening an account, put your first $100 in a broadly diversified ETF that represents the entire stock market, such as the Vanguard Total Stock Market VIPER. Every month after that, continue investing as much as you can. Put 100% of each month's contribution into one of the following ETFs, each of which invests broadly in one of five major asset classes:

• Vanguard Total Stock Market VIPER (VTI, news, msgs), which tracks the Wilshire 5000, an index of approximately 6,500 U.S-based stocks. It's like buying virtually the entire stock market.

• iShares MSCI-EAFE (EFA, news, msgs), which corresponds to the Morgan Stanley index of stocks trading in Europe, Australia and the Far East.

• iShares Lehman Aggregate Bond (AGG, news, msgs), which attempts to track the price and yield performance of the total U.S. investment grade bond market.

• iShares Dow Jones US Real Estate (IYR, news, msgs), which holds a basket of 75 real estate investment trusts (REITs) that represent that sector of the U.S. economy.

• iShares Dow Jones US Basic Materials (IYM, news, msgs), which includes stocks in the energy, basic materials and precious metals sectors.*

*(Once your portfolio reaches a total value of at least $25,000 -- and it will! -- you'll want to switch your commodity allocation to the PIMCO Commodity Real Return Strategy fund (PCRDX), which more accurately captures the returns of the commodity futures market than a collection of stocks can. The fund has a minimum initial investment of $2,500, which makes it impractical for smaller accounts.)

As you invest in subsequent months, rotate your purchases among the five ETFs until you reach your target percentage for each one. Concentrating your purchase in a single ETF each month minimizes your commission costs.

An easy, real-world portfolio

This real-world portfolio, unlike the equal-weight example, puts a little extra in U.S. and foreign stocks. That's where most of your growth is likely to come. It also adds a fixed-income asset class, bonds, to give your portfolio extra stability in rough markets.

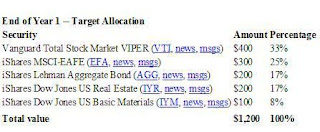

After a year has passed, you will have invested $1,200, and your portfolio would look something like this:

Congratulations! You've built a portfolio that will ride out the market's ups and downs a lot more smoothly than most.

In actual practice, however, you'll find that some of your investments have grown in value while others have lost money or stayed about the same. Also, about 4% of your investment will have gone to pay commissions.

But for this simplified example, let's suppose that your U.S. stock holdings increase 50% in value, while your foreign stocks decline 33%. We'll also magically erase the cost of commissions. There on the bottom line is a $100 profit! Your portfolio is now worth $1,300 and looks about like this:

But now you have too much money in U.S. stocks and not enough in foreign stocks. To restore your portfolio to its target percentages, you'll need to invest more of your new money in the assets that have done poorly. (This isn't as dumb as it seems at first blush: It disciplines you to buy more when prices for an asset class are low.)

Rebalance with new money

The basic idea is to keep your allocations close to the target by adding new money, rather than selling your winning funds, which will generate a taxable profit. This is called rebalancing and should be done at least once a year to bring your portfolio back in line with your target allocation.

The easiest way to rebalance is to add each month's $100 investment to whatever asset class is farthest below your target allocation for it. If they're all about equally in line, then start rotating through each of the five as you did in the beginning.

Once you've established your target allocation, stick to it. Succumbing to the temptation to guess what the next hot asset class will be your surest ticket to mediocre returns. The key to success is discipline.

Saturday, July 12, 2008

Start investing with just $100

Subscribe to:

Post Comments (Atom)

2 comments:

saya baru tau ada blog alumni MO, apakah blog ini dibuat oleh MO sendiri? Keep sharing..

Yang Buat alumni megaoptions Saya Ridwan angkatan 37, boleh lah info ke teman2 untuk diskusi di sini secara teknikal bisa juga...

Post a Comment